13-44 Green Hydrogen Can Work – Just Ignore Economics and Common Sense

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Spotify | Amazon Music | TuneIn | RSS | More

Show 13-44 Summary: People have been chasing the elusive dream of hydrogen as a fuel source for decades and decades. Billions have been poured into it before now. But there’s no such thing as a bad idea as long as the government is willing to pour even more billions into it. But now it’s even worse as they chase “green hydrogen.” Tune in to hear why hydrogen isn’t viable as a mass production “fuel,” how it isn’t even a fuel, and even far more expensive than it already is if we try to make it the way the Greenies want. And remember how CO2 is the enemy? Yeah not so much, apparently.

The I Spy Radio Show airs weekends, six different times, on seven different stations. Listen anywhere through the stations’ live streams! Check out when, where, and how to listen to the I Spy Radio Show. Podcast available Mondays after the show airs on out network of stations.

Original Air Dates: November 4th & 5th, 2023 | Guest: Frank Lasee

This Week – Why Green Hydrogen Doesn’t Make Sense

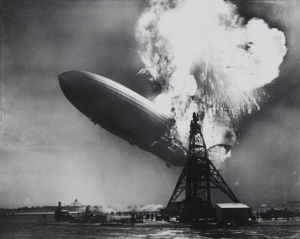

Hydrogen has been the elusive clean energy society has been chasing for decades. Well before G.W. Bush threw nearly $2 billion at (which went nowhere), scientists were trying to use hydrogen back into FDR’s days and even before then. (The Hindenburg largely derailed the whole idea.) But if clean hydrogen was a pipe dream, green hydrogen is a fanciful nightmare. Especially if you don’t care about things like economics or common sense.

In a nutshell, green hydrogen costs 5–6 times more than current methods and does not return as much energy as it costs to produce.

But why let a few dozen billions of narrow-minded taxpayer dollars stand in your way of your grand vision? Especially when states like Oregon and Washington just got handed a billion dollars each of free taxpayer dollars to create hydrogen hubs.

But First: A Big Win!

Thanks to public outcry, which CFACT helped mobilize, Orsted has cancelled its two planned offshore wind farms in New Jersey waters. The Danish company our American taxpayer dollars was funding, pulled the plug. Despite a $100 million penalty for failing to complete delivery. And wrote off a $4 billion loss. Amazing how these “green energy” schemes cannot work without massive government subsidies.

Public outcry works. Don’t be silent. And let’s do that here in Oregon. See Show 13-42 for more information.

Green Hydrogen Defined

We welcome first-time guest, Frank Lasee, a former Wisconsin state senator, president of Truth in Energy and Climate, and a senior policy advisor to CFACT. As you might be able to tell from the name of his organization, there’s not a lot of truth out there in either climate or energy. And nowhere is that more true than green hydrogen.

First off, hydrogen is itself not really a fuel. It’s more akin to a battery because while it has energy, it first has to be created. It would be a bit like creating oil out of various elements first before drilling for it.

Hydrogen must be made; it is not a fuel. It is a storage device, like a battery. If not handled properly, it can go boom! In a great big ball fire.

– Excerpt from “Hydrogen – Will this Green dream prove an expensive nightmare?” by Frank Lasee

What is green hydrogen? The label “green hydrogen” is all about how the hydrogen is made. There are several ways to make hydrogen. One is a simple electrolysis method, applying a current to water that splits the molecules into hydrogen and oxygen. Your high school science teacher might have demonstrated this. Another is gasification that extracts hydrogen (and other elements) from natural gas with high-temperature steam.

Green hydrogen is extracted from whatever source but must use “renewable” energy to do so. The most common being pushed right now is to use solar and wind as the energy source.

How Green Hydrogen is Made

Except there’s a major problem with “green” wind and solar. They do not produce energy 70% of the time. Barely any wind. No wind. Not enough sun. Darkness. But to make clean, green hydrogen at scale takes enormous amounts of electricity. And water. Lots of water.

To make one kilogram of hydrogen (which has roughly the same potential energy as a gallon of gas), you need 13 kg of water to split. The water is heated to 2,000 degrees. That’s a lot of electricity. And then after it’s split, it has to be superchilled to near absolute zero so it can be pressurized and stored. And that takes another 40 kg of water to cool it.

So for every 1 kg of hydrogen produced, it takes 53 kg of water — and a massive amount of electricity.

What happens if the wind’s not blowing? Or it’s night time? You don’t have to be a paid TV scientist to realize this is not a process you can start and stop because of the unreliability of your “green” power sources. Gosh. You’ll have to supplement all intermittent green energy with coal. Or have massive batteries.

The Green Hydrogen Dilemma

One notion to get past the unreliability of so-called green energy and its unreliability is to tap into hydroelectric dams. Which the Pacific Northwest has plenty of. Except for the last decade, the environmentalists have been busily trying to yank them all out. To “save the salmon.”

Now what? Save the salmon or have green hydrogen?

In fact, the hypnotic allure of billions free taxpayer dollars has put a halt on at least one lawsuit to force the government to pull out dams on the Snake River.

Whoops.

But it’s not just the dams. You’ve got California, which on Thursday emptied 7 billion gallons (7,559,743,200 gallons to be precise) of fresh water from its reservoirs into the ocean. Why? To adjust the salinity levels in a delta to “save the fish.” The Delta Smelt. Of which a grand total of zero Delta Smelt have been seen in annual Fall Surveys since 2017.

Well there goes 142,636,664 gallons of hydrogen they could have made.

Fish or dams for hydrogen? What to do, what to do…

Green Energy: It’s All About Money

Tune in to hear how “green energy” is not green. And it’s not really about energy. What it’s really all about is the money.

And it’s not about “Climate Change” either. Why? Because while we’ve been shrieked at about CO2 emissions for two decades, it turns out they will not only sacrifice fish to get those billions. They’re also willing to emit more CO2 to get those billions.

Just like wearing the inappropriate “green” label for green hydrogen, to get the label “clean hydrogen” all you have to do is not emit more than 2 kg of carbon dioxide per hydrogen produced.

Read it for yourself: The National Clean Hydrogen Standard is 2 kg CO2e/kg H2. That’s 2x the amount of CO2 for every one Hydrogen (H2). See page 75 of the H2IQ Presentation from the U.S. Dept of Energy.

Yes. You can emit twice the CO2 you get of hydrogen. So much for CO2 as the enemy.

Don’t miss the show. That’s just one of much of the green hydrogen nonsense.

The I Spy Radio Show Podcast Version

Trapped under a heavy object? Missed the show? Don’t worry—catch the podcast version. I Spy Radio is now available on your favorite platform, or you can grab it right here. See the full list of podcast options.

Research, Links Mentioned & Additional Info

Articles/Info Mentioned During the Show

- Frank Lasee’s website is TruthinClimateandEnergy.com. Be sure to check out this website for great articles and information.

- Major wind energy developer scraps two big offshore projects (NBC News, Nov 1, 2023)

- The move by Orsted, a Danish company, adds fresh uncertainty to an industry supporters see as a way to help end the burning of planet-warming fossil fuels.

- Read it for yourself! Page 75 of the H2IQ Presentation (Dec 2021) from the U.S. Department of Energy states “clean hydrogen” allows for twice the amount of CO2 emissions as the hydrogen produced.

- Interview with Frank Lasee: “Biden Sabotaging U.S. Energy Grid, Warns Expert” (Conversations that Matter, via YouTube, March 13, 2023)

- Great example of replacing a gasoline car with a solar cars. Now you’re paying for 3 cars to get the same reliability you had in one.

- Hydrogen – Will this Green dream prove an expensive nightmare? – (CFACT, Oct 26, 2023)

-

- Hydrogen embrittles nearly every metal it comes in contact with.

- Needs 13x more water than hydrogen made, 40x to cool it

- The hydrogen lobby duped Congress into $9.5 billion for hydrogen hubs and $100s of billions more for subsidies to make it. These hydrogen jobs will last only as long as the subsidies do.

-

- Great Analysis! Why Hydrogen Cars Flopped (YouTube, April 12, 2021)

- The decades-long elusive dream: “The Truth About Hydrogen” (Popular Mechanics, Oct 31, 2006)

- Study: ‘True Costs’ Of Electric Vehicles Far Higher Than Most Believe (The Daily Wire, Oct 27, 2023)

- Auto execs are coming clean: EVs aren’t working (Business Insider, via Yahoo News, Oct 26, 2023)

Oregon’s Green Hydrogen Scheme

- Pacific NW wins $1 billion from feds for ‘Clean Hydrogen Hub.’ Now what? (News from the States, Oct 13, 2023).

- Court case on fate of Snake River dams, imperiled salmon postponed (Oregon Capital Chronicle, Oct 31, 2023)

- Officials tell public newly approved Northwest hydrogen hub will produce jobs, economic benefits (Oregon Capital Chronicle, Oct 31, 2023)

More of Frank Lasee’s Terrific Articles & Interviews

- Bidenomics Is Scarier Than A Haunted House On Halloween (Frank Lasee, Oct 31, 2023)

- Interview with Frank Lasee from Truth in Energy and Climate (Alliance for Free Citizens, Sept 7, 2022)

- 8,000 square miles of solar panels to make enough electricity for the U.S. plus 1 million wind mills. We have 75,000 now.

- Bi directional batteries – so the cars can power the grid, which got its power off the grid.

- Joe Biden’s Hydrogen Slush Fund Means More Dollars Wasted On The Green Energy Boondoggle (ShoreNews Network, Feb 26, 2023)

- Don’t Buy Green Hydrogen Hype (Iowa Climate Science Education, Apr 12, 2023)

- Bidenomics at Work: ‘Green’ Hydrogen Is a Very Expensive Waste of Money (RealClearEnergy, Oct 6, 2023)

- Frank Lasse article: “The Expensive Impossibility of Green Hydrogen From Part-Time Wind and Solar” (Truth in Energy & Climate, October 25, 2023)

- “The fact that the world is desperately short of lithium and cobalt for electric vehicle batteries, at the scale they want to force, is dawning on them”

- “Wind and solar produce little or no energy 70% of the time.”

- Frank Lasee: Joe Biden’s Hydrogen Slush Fund Means More Dollars Wasted On The Green Energy Boondoggle (ShoreNews Network, Feb 26, 2023)

Related Stories

- GH2 Facts: CO2 emissions per kg of hydrogen depending on the method of production (Hydrogen Newsletter, Jan 17, 2023)

- Scientist Can’t Understand why Antarctica hasn’t warmed in 70 years despite CO2 rise (CFACT Lasee, Feb 9, 2023)

- Wildfires are on the decline worldwide according to NASA (CFACT Lasee, June 9, 2023)

- Chinese Green Tech Companies Pose National Security Risks to US, Report Says (Epoch Times, Oct 24, 2023)

- Hydrogen Basics (via Alternative Fuels Data Center, no date)

- Hydrogen Fuel Basics (U.S. Office of Energy Efficiency & Renewable Energy, No Date)

- The Hydrogen Boondoggle is an Enormous Slush Fund (FrackCheckWV, March 14, 2023)

- ‘Worst Case of Misinformation’: Ecomodernist Says Planet Healthier Than What Climate Activists Claim (Epoch Times, October 31, 2023)

- Alternative Fuels Data Center: Hydrogen Production & Distribution (Dept of Energy, No Date)

Then we talk to

Then we talk to