15-34 Showdown: HB2025 Special Session, ODOT Tax Increase

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Spotify | Amazon Music | TuneIn | RSS | More

Show 15-34 Summary: Oregon Democrats are at it again. This week, it’s about prepping for the big special session coming up Friday, August 29th, to stop the Democrats from trying to ram through a massive tax increase disguised as ODOT funding in HB 2025. But is the ODOT tax increase really necessary? We talk with representative Alek Skarlatos about what’s happening and things he has seen as a freshman representative. Including some mismanagement at ODOT he personally knows about.

The I Spy Radio Show airs weekends, seven times over the weekend, on seven different stations. Listen anywhere through the stations’ live streams! Check out when, where, and how to listen to the I Spy Radio Show. Podcast available Mondays after the show airs on our network of stations.

Air Dates: August 23 & 24, 2025 | Guest: Alek Skarlatos

This Week – ODOT Tax Increase Special Session

Okay. Let’s start off with the most important thing about this week’s show: take action. Don’t be silent.

Submit your testimony to the legislative committing hearing HB 2025. And don’t forget to contact your legislators personally. Contact info for representatives is here and for senators is here.

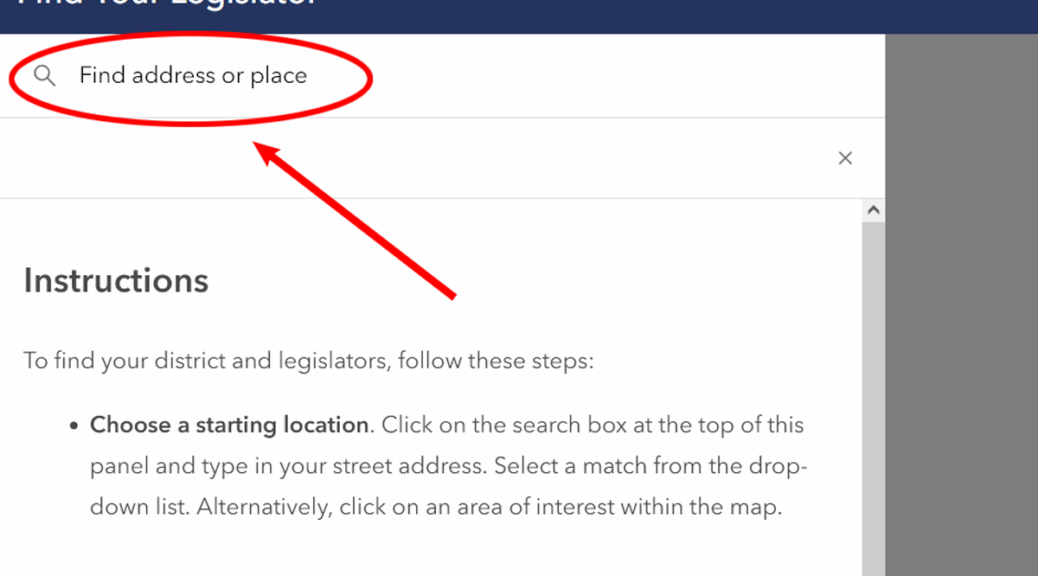

Not sure who your legislators are? We’ve got you covered: use this map (search by address is in the top left).

And it wouldn’t hurt to let squishy Republican representatives Cyrus Javadi and Kevin Mannix know you want them to vote no.

Massive Oregon Tax Increase: ODOT Will Penalize Everyone

Some taxes you can avoid. Like sales taxes (and, yes, Oregon has sales taxes, just not on everything). But the ODOT tax increase will impact everyone. If you buy anything, it arrives on a truck. And often, it involves multiple trucks. At each stage, each of those trucks will be paying more. So you will be paying more. If you go to the store in a car, you get personally hit.

And it’s unnecessary. Oregon Republicans came up with a plan to make sure ODOT was fully funded — without raising taxes. Just force ODOT to prioritize its current spending. And stop ODOT”s wasteful spending.

Shouldn’t all wasteful spending in government come to a screeching halt?

ODOT Mismanagement

We welcome back Alek Skarlatos, a freshman representative from Oregon’s HD-4 in Oregon’s southwest. Alek is seeing the session through fresh eyes and it’s not always pretty. We talk about the upcoming special session. And we talk about reforming ODOT. There’s no question it wastes money. And there is even evidence of fraud. (See “fraud” in the show notes below.)

But perhaps the answer to Oregon’s Department of Transportation isn’t in Oregon. It’s across the ocean.

The I Spy Radio Show Podcast Version

Trapped under a heavy object? Missed the show? Don’t worry—catch the podcast version. Mondays, after our network of radio stations have aired the show, I Spy Radio is now available on your favorite podcasting platform, or you can grab it right here. See the full list of podcast options.

Show Notes: Research, Links Mentioned & Additional Info

- Don’t be silent. And don’t wait! Get your comments in before Friday’s special session!

- Submit your testimony to the legislative committing hearing HB 2025. And don’t forget to contact your legislators personally. Contact info for representatives is here and for senators is here.

- Not sure who your legislators are? We’ve got you covered: use this map (search by address is in the top left).

- It wouldn’t hurt to let squishy Republican representatives Cyrus Javadi and Kevin Mannix know you want them to vote no. Let the democrats get the blame.

- As of our interview with Alek Thursday afternoon, the latest version of HB 2025 hadn’t even been released yet. But it is now. Read the latest draft of HB2025 (PDF).

- Looks like fraud: ODOT retroactively changes bids to hide its overspending. “Unaccountable: ODOT covers up cost overruns” (City Observatory, May 22, 2025)

- “ODOT also has a practice of “re-baselining” a project—retroactively altering the initial cost estimate to conceal cost increases. …ODOT permits itself to change the baseline construction budget—”re-baselining”— after a project has started construction. This practice allows ODOT staff to retroactively change the base budget for the project, allowing it to claim that the cost of the project hasn’t increased, and hiding cost overruns.”

- How is that even legal? If a private business cooked their books like that, it’s hard to imagine how everyone involved not ending up in jail. Pretty sure an accountant would lose their license if they changed budgets after the fact to hide overruns.

More Reasons ODOT Needs a Full Audit

- ODOT’s “Strategic Review”: Conflicted consultants whitewashing mismanagement (City Observatory, March 28, 2025)

- ODOT’s Reign of Error: Chronic highway cost overruns (City Observatory, June 9, 2025)

- In Extraordinary Hearing, ODOT Explains Billion-Dollar Budget Blunder (WWeek, Fen 26, 2025) *The transportation agency failed to perform a basic accounting function.

- ODOT’s Most Persistent Critic Says the State Could Solve Its Road-Funding Crunch—by Scuttling Some Projects (WWeek, Aug 20, 2025)

- Audit finds ODOT overestimated revenue by $1.1 billion for 2023-25 (Central Oregon Daily News, Feb 26, 2025)

- Audits reveal ODOT projects from 2017 funding package are over budget and behind schedule (OPB, Feb 20, 2025)

- Kotek’s hissy fit: ODOT layoffs announced: Potholes fixes, fire prevention, plowing, camp cleanups take a hit July 7, 2025 (Central Oregon Daily News, July 7, 2025)

- ODOT doesn’t have an extra billion dollars after all, which may result in shelved projects (KGW, March 5, 2025)